Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia. The ongoing special tax relief of RM2500 which is allocated specifically for the purchase of phones computers and tablets will be extended for a second time from 31 December 2021 to 31 December 2022.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Special relief for domestic travelling expenses until YA 2022.

. Tax relief on PRS contribution up to RM3000 until the year of assessment 2025. This relief is applicable for Year Assessment 2013 and 2015 only. This infographic will give you an overview of all the tax deductions rebates and reliefs that you can claim for YA2020.

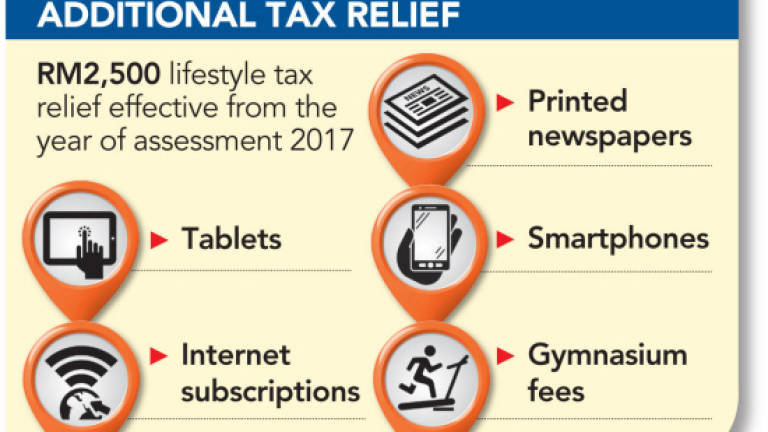

Education fee for tertiary level or postgraduate level. Tax relief of up to RM2500 is claimable for purchases of lifestyle equipment for personal use by yourself your spouse or children. This additional relief is available for purchases made between 1 June 2020 and 31 December 2022 provided that the total amount claimed under the special tax relief has not been claimed under lifestyle tax relief.

Laptops personal computers smartphones or tablets. Lifestyle Purchases For Self Spouse or Child. So if you bought a computer that costs more than that you can no longer include your gym.

The above is in addition to the existing lifestyle relief of MYR 2500 whereby the cost of purchasing a handphone notebook or tablet is claimable by resident individuals as part of the lifestyle relief. 28 rows books journals magazines printed newspapers. For spouse without income.

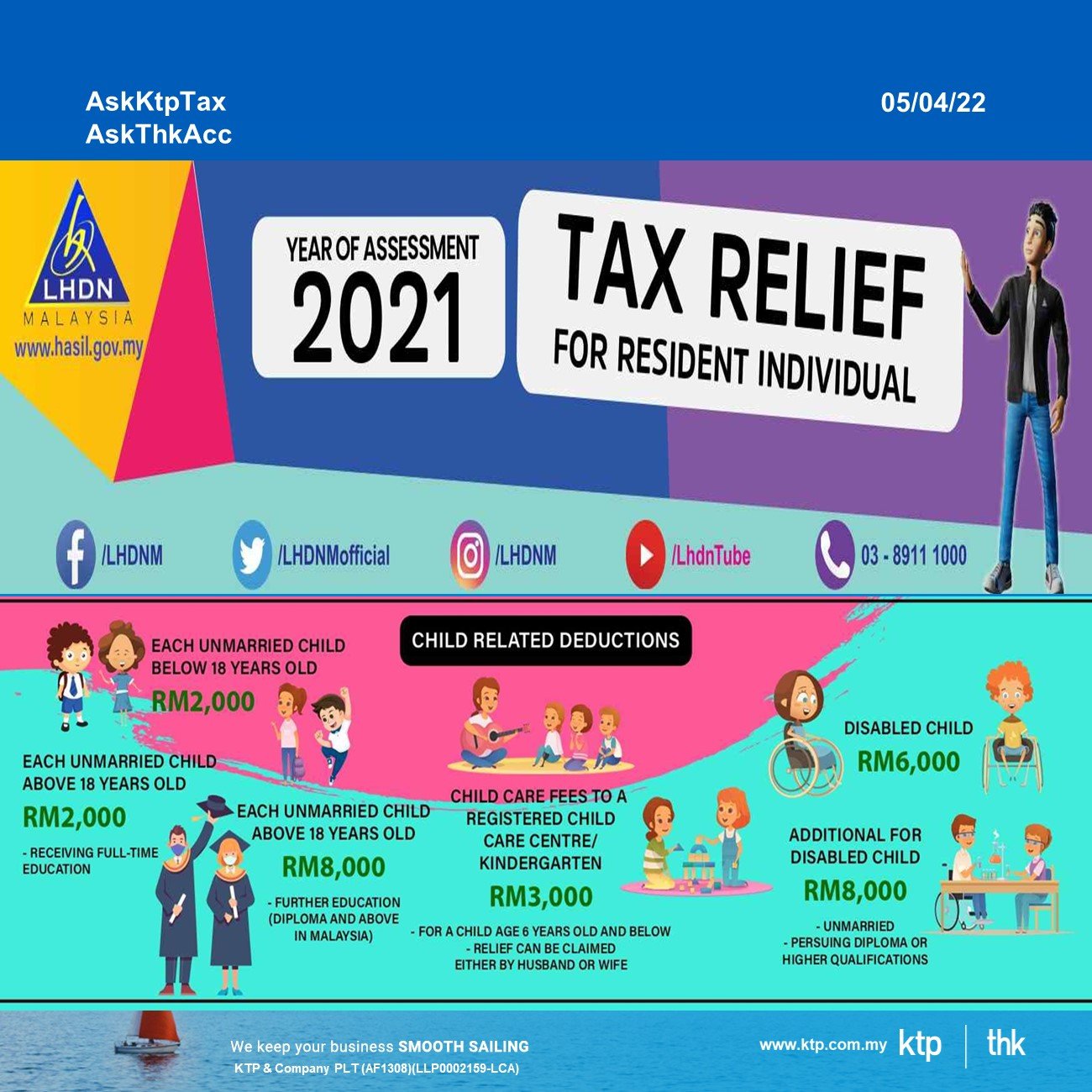

Computer annually payment of a monthly bill for internet subscription. Under the PENJANA recovery plan there is an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000 which applies to the Year of. Ii Spouse Alimony RM 4000.

The deadline for e-filing your income tax form is on 15 May 2022 but before that make sure you claim these tax reliefs and possibly get back some money. Additional Lifestyle Relief. Under the special lifestyle tax relief the IRB states that an individual can claim for the purchase of a personal computer smartphone or tablet for the use of self spouse or child as well as not for the purpose of own business up to RM2500 in tax relief.

Here are some of the other exciting financial perks you can enjoy in 2022. Expansion of tax relief on EPF Contributions up to RM4000. Books Internet Subscription Sports Equipment Personal Computers Smart Phones Tablets and Gym Subscription.

Medical treatment special needs and carer expenses for parents Medical condition certified by a usebenefit medical practitioner RM8000. Personal Computers Smart Phones and Tablets. Please note that is for personal equipment only additional charges.

Effective Year of Assessment 2020 and Year of Assessment 2021 there are 2 types of lifestyle reliefs claimable-. If thats the case you claim up to RM4000. You are allowed to.

What are the tax reliefs available for Malaysian Resident Individuals in 2020. The maximum tax relief amount. LHDN provide tax relief for Covid-19 tests and vaccination.

The Inland Revenue Board IRB or Lembaga Hasil Dalam Negeri Malaysia LHDN has announced that e-Filing submissions for Income Tax Returns for the 2021 year of. The special tax relief is claimable for YA2020 only. A third additional lifestyle tax relief that is allocated specifically for sports-related expenses.

Tax Relief for Individual Spouse. I Education RM 7000. Reading materials like books journals magazines printed newspapers and other publications e-newspapers excluded for now.

The payments must be made between 1 March 2020 and 31 December 2020 to qualify for tax relief in YA 2020. Medical expenses for serious diseases for self spouse or child. Alimony to former wife Agreement needed iii Insurance.

Upgrade your lifestyle Credit. This is a new tax relief introduced as part of the response to the Covid-19 pandemic. Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000.

In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or tablet for self spouse or child was added and extended to Year of Assessment 2021. To include voluntary contributors and pensionable government servants. Tax payable RM45850 x 8 tax rate RM3668.

Extension of tax relief for childcare centres and. Life insurance RM 3000. This relief was introduced in mid-2020 before being extended to YA 2021 and most recently it was confirmed.

Moreover the accommodation premises must be registered with the Commissioner of Tourism to be eligible for the relief. This special tax relief was originally introduced under the PENJANA economic recovery plan as a way to boost work-from-home arrangements as. If youre thinking of subscribing to an electronic newspaper outlet now is the best time as its now included as a lifestyle relief.

RM4000 for husband wife alimony payment to ex wife RM5000 for diabled husband wife. Lets say your husband or wife doesnt work or need to pay income tax. Also known as lifestyle tax relief in Malaysia this is the single persons favourite category under the topic of Personal Tax Reliefs.

Husband and wife thingy also can claim. Pursuing a full-time degree or equivalent including Masters or Doctorate outside of Malaysia. LHDN confirmed that taxpayers you would be able to claim tax relief for Covid-19 expenses for themselves their spouses and children in their assessment for 2021.

The amount has also been increased from RM2500 to RM3000 with the extra. Income tax season is upon us. The Finance Ministry has also announced tax relief measures for the year of assessment 2021 and they are.

The maximum income tax relief amount for the lifestyle category is RM2500. During the tabling of Budget 2022 the government has proposed to extend the special tax relief of RM2500 for the purchases of phones computers and tablets lifestyle expenses to 31 December 2022. As of the assessment year of 2021 in this category you can claim for the purchase of.

Unlike tax reliefs tax deductions reduce the amount of your aggregate income which is the sum of your total income for the year put together. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. This special tax relief was originally introduced as a way to assist Malaysians in adopting the work-from-home culture following the.

Sports equipment and gym membership fees.

Malaysia Personal Income Tax Relief 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysia Personal Income Tax Relief 2022

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Penjana Tax Relief And Stimulus For Malaysia Budget 2021 Financio

Pm Announces 4 Additional Tax Reliefs Including Newspaper Subscriptions For Budget 2017

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Personal Tax Relief 2021 L Co Accountants

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020